Before we get too deep into Fed policy and how the government will have a very difficult time ending their artificial life support called QE3, let’s talk about what it means to your risk management strategy.

Before we get too deep into Fed policy and how the government will have a very difficult time ending their artificial life support called QE3, let’s talk about what it means to your risk management strategy.

Bonds are one of the most complex, varied investments on the planet compared to stocks, which are simple and easy, so don’t be discouraged if you don’t understand what moves the bond market. Let me try to explain it:

When you buy a bond, you are loaning money to the issuer of that bond. In the case of US Treasury bonds, you’re loaning money to the US government with the guarantee that they will pay you a fixed rate of interest each year for the life of the bond and that they will return 100% of your money when the bond matures. None of those things changed in 2013 when the market value (key words) of the 10-year Treasury fell almost 14%.

Most people have a difficult time with this drop because they look at bonds like they do stocks and other investments that don’t have any guarantees of interest or repayment. They look at the daily market value instead of looking at the fact that no matter what happens, if they simply hold their bond until it matures, they will get back 100% of their principle and will be paid a fixed rate of interest every year until maturity. What’s not guaranteed on any bond (including Treasuries) is the market value of the bond at any given point before maturity. In other words, if you attempt to sell your bond to someone else before it matures, there is no guarantee that it will be worth what you paid for it. The promise of principle repayment only comes in at maturity.

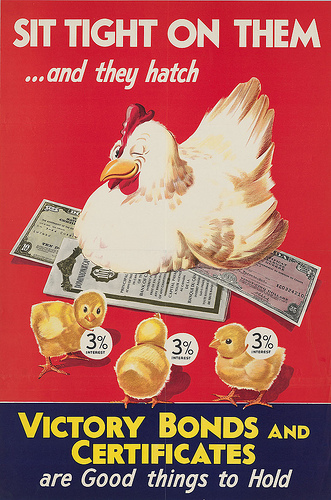

Let’s play this scenario out a bit and look at what happens when rates rise but let’s put it in even simpler terms. Suppose you bought a CD from a bank that had a 10-year maturity and that CD guaranteed you a 3% interest payment per year and also guaranteed your money back at the end of the 10 years. And let’s assume that the day after you bought that CD that the bank raised their rates on 10-year CD’s to 4%. Since you are locked in at 3%, the rate increase does not affect you, right? That is unless you decide you wanted out of the CD and try to find someone on the open market to buy it from you. If I am the potential buyer of that CD on the open market, and I have $100,000 to invest, I have two choices:

- I can take my money and buy your 3% CD or

- I can go to the bank and buy a 4% CD.

Clearly there is no reason I would buy your 3% CD if I can get one at 4% EXCEPT if you offered me a discount on your CD. Instead of giving you $100,000 for your CD, I might give you $90,000 to compensate for the fact that I am locking in a lower yield than the going rate. That is exactly what happened to Treasuries last year. If you tried to sell your 10-year Treasury bond on the open market, you would have had to offer a nice discount because Treasury rates went up. Is that a loss? The answer is yes but only if you had to sell out of that investment at that moment. Unlike stocks, or real estate, or commodities, if you simply hold on to a bond until it matures, you are promised to get back your money. Obviously the promise is only as good as its maker but you get the idea. Keep that in mind the next time you look at your brokerage statement and see the “early liquidation value” of the account down because of your bonds.

*****

Information presented in this blog post is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Discussions and answers to questions do not involve the rendering of personalized investment advice, but are limited to the dissemination of general information and may not be suitable for all readers. A professional adviser should be consulted before implementing any of the strategies presented.